Today, the smartphone and its apps are part of everyday life for most consumers. There are apps about the weather, social networks, saving money and even losing weight. The insurance industry has also recognized the smartphone as a way of offering insured persons additional services. But what is an insurance app anyway?

Table of Content

- Many Different Variants

- New Development In The Insurance Market

- What Exactly Is An Insurance App?

- A Broker Mandate Is Transferred To The App

- Insurance Apps Without Creative Solutions With Customer Benefits

- What To Watch Out For With Cross Platform Apps For Insurance

- Conclusion

Many Different Variants

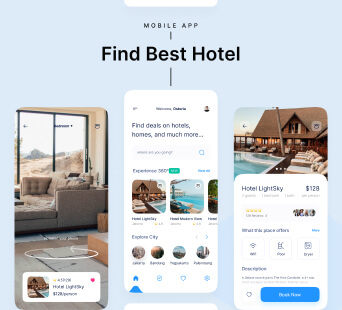

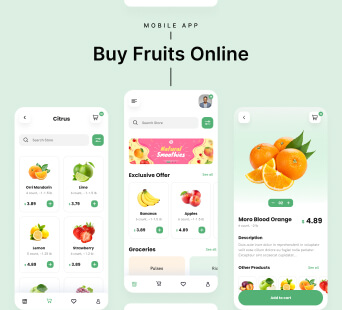

When people talk about insurance apps by app developers uk today, they can be very different applications. As a rule, it is not a pure administration app that is used to manage contracts, customer data and policies, but much more.

Modern insurance apps are comparable to insurance brokers who recommend various products to their customers and receive a commission from the insurance company for the conclusion. Policyholders should therefore take a very close look at the respective app. It can be the case that insurance contracts that can only be concluded for a few days via an app are significantly more expensive than comparable offers from an insurance broker or agent.

New Development In The Insurance Market

Insurance apps are still a relatively new development in the insurance market. The providers are mostly young start-ups who want to renew and simplify the insurance market.

The providers work in a similar way to conventional insurance brokers - with the difference that most of the communication and contract management takes place via an app.

What Exactly Is An Insurance App?

An insurance app is an application for a smartphone, tablet or PC. With this application, users can view all personal insurance contracts or upload and manage documents. At the same time, the app acts as an insurance broker.

Anyone who uses an insurance app should be aware that they depend on an electronic device to manage their policies. At the same time, consumers should consider whether they want to save their personal insurance data digitally with a provider.

A Broker Mandate Is Transferred To The App

The app providers work like an insurance broker. For this reason, when you use the app, you transfer a mandate to it. All of your insurance data as well as personal data on your place of residence, marital status or income are saved by the provider. With the transfer of the broker mandate, the app can not only manage your insurance policies on your behalf, but also check contracts, adjust coverage amounts or take out new insurance policies for you.

Changes may only be made with the consent of the user, but with the mandate you are handing over far-reaching powers to the app provider.

At the same time, by transferring the broker mandate to the app, an existing mandate with a broker is terminated. This is then no longer your contact for insurance questions.

Insurance Apps Without Creative Solutions With Customer Benefits

Insurance companies are beginning to understand that apps on smartphones or tablets can be a great way to attract customers and nurture existing customers. Therefore, digitization teams with sometimes adventurous names are put together in the insurance companies, which then develop concepts and ideas for insurance apps. You are not particularly brave about it. Instead, you only try to transfer existing processes to digital. In many cases, this is simply boring and often not thought through.

Many insurance companies do not yet have their own app and leave the field to insurance comparisons. Even if word of their business model is getting around and fewer consumers assume that they are actually being informed independently and neutrally in these comparisons, the web- and app-based comparisons are clearly ahead.

The industry is oversleeping the app age with its opportunities. And if an insurance company comes out with an app, then it is about claims settlement in motor vehicle accidents, emergency help or general advice. It is also noticeable that the insurance apps are anything but inviting in the app stores.

Who Actually Thinks Digitally When It Comes To Insurance?

Today, insurance companies need a think tank, a kind of start-up team in the company. This team should be able to think and experiment freely, without having to submit to the often-prevailing objections "we have always done it this way".

Today, it is important to question traditional structures and processes and to rethink them. This not only results in more efficient processes, there is also the chance that this will open up new business areas that were previously thought to be impossible.

What To Watch Out For With Cross Platform Apps For Insurance

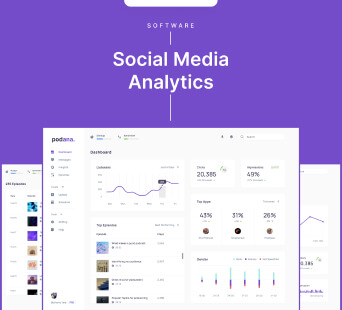

The initial development of cross platform apps is faster than with native apps. This option is therefore well suited to achieve results quickly, for example in the form of prototypes. To start with, ask yourself how fast you want to get the app to market. Cross platform apps can also be cheaper to maintain than native apps.

As with native apps, cross platform applications are not spared from operating system updates. Accordingly, Google, Facebook and Co. have to adapt their frameworks to the new conditions. The plugins in the developer communities also need to be updated. Since not every community member publishes their updates at the same time, this can lead to compatibility problemsof the plugins and thus higher maintenance costs. The communities include developers who devote their free time to plugins, companies that support open source libraries, and first-party support for plugins from large companies.

Make sure that the necessary plugins are also available for all operating systems that you want to use with your Cross-Platform App. Flawless plugins are already available for many hardware interfaces. If these meet your requirements and wishes, that speaks in favor of development with cross platform technologies.

The frameworks are subject to constant change and are therefore always associated with uncertainties.

Conclusion

A top mobile app development agency such as Hyperlink InfoSystem UK can assist you with the development of a top insurance mobile app. We will assist you with the integration of all the necessary features and functionalities to ensure that your mobile app goes viral. We are well experienced as we have helped many of the biggest brands in the world with the development of excellent solutions.