Investment has been a headache for most people out there. Whether it could be managing the investment, learning the investment or teaching how to do that. As it demands the investment of time, effort and money with better judgment and planning every single time.

But there is one thing that can make it easier for everyone out there - Mobile app development. Investing in mobile app development demands a one-time investment from your end and makes the investment process and financial planning easy for almost everyone out there. But first, you have to invest a rightful amount of time and effort throughout the investment app development process.

Types of Investment Mobile Application

Do It Yourself (DIY):

DIY investment mobile applications do not offer any kind of advisory assistance. These applications ordinarily include straightforward connection points that give market change information and fundamental figures and tools for exchanging, creating and managing portfolios.

Robo-advisors:

This type of mobile application uses AI algorithms to investigate authentic information, Robo-counselor contributing applications and predict market patterns. Then, considering client preferences and behavior the investment mobile application recommends the best investment choices.

Hybrid:

Hybrid financial planning applications consolidate DIY and Robo-advisor to empower any style of speculation. A genuine illustration of a Hybrid investment solution is M1 Finance, which permits clients to depend on innovation or pursue their own choices while dealing with their portfolios.

Human Advisor:

You can make an investment mobile application that focuses on human advisory services. Or on the other hand, you can coordinate this as a high-level feature to any investment mobile application. In-person guides are a bit costlier however you can offer a better choice for the people who need to look at the condition of their individual budgets and track down potential open doors for investments.

Micro-investing Apps:

Micro-investment mobile applications are a hot pattern, and you ought to think about exploiting them. They permit individuals to make little and periodic investments from regular transactions. On account of micro-investment options, users can round off their purchase to contribute their loose coinage further. For instance, Starbucks' Caffe Latte Grande at $3.65 will be rounded off to $4 with 35 pennies to be contributed.

Regardless of whether the investment app development project appears to be overpowering right away, you do not have to go through years making an investment application. All you really want is a unique thought, a robust plan, and a team of proficient app developers uk to develop the mobile application that can help you at each phase of your process: starting from the project requirement gathering to launching the mobile application.

Things to Consider for Investment Mobile App Development

Account Creation

You ought to develop a feature-rich investment mobile application where individuals can create an account and without much of a stretch track income and investment, and survey and change their portfolio occasionally.

Transaction Management

Your investment management mobile application ought to permit clients to manage, invest and transect funds utilizing tech-savvy innovation through their mobile phones.

Multi-currency Management

To connect much more crowds, you should allow your users to invest through multiple currencies.

Cryptocurrency Trading

Furnish individuals with the likelihood to trade cryptocurrency through your investment mobile app development, guaranteeing exchanges are going on quickly and without any system blunders.

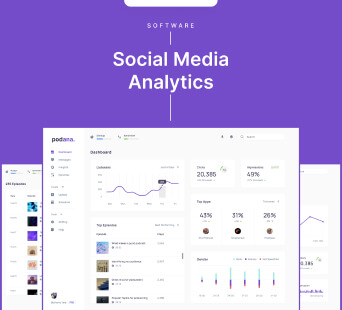

Analytics Dashboards

A dashboard that will naturally introduce data in an easy-to-use way gives bits of knowledge your users need to decide.

KYC and AML Integration

Investment mobile applications that assist with putting away cash ought to meet the Know Your Customer (KYC) and Anti Money Laundering (AML) fintech security prerequisites without forfeiting the client experience.

Real-time Alerts

Outfit clients with custom push notifications, updates, and real-time alerts. Along these lines, you can keep your customers updated about the financial exchange status, profits from speculations, unusual transactions, extraordinary offers, and discounts.

Automated Counselors

Furthermore, contemplate coordinating Robo-advisors (AI integrated investment assistance) into your fintech software development services.

Investment Calculators

Assist buyers with sorting out how they can meet their goals, looking at essential speculation, time of deposit, recurrence of commitments, and hazard resilience.

24/7 Assistance

You ought to devise ways users can connect with you on the off chance that they have questions. In this way, consider executing a chatbot, a callback choice, or a support team that can resolve client issues whenever they want.

Mobile App Design

The design of an investment application shouldn't contrast much from the ones of other fintech applications. Simply ensure it is powerful, secure, and real-time data perception. Your mobile application ought to likewise deal with enormous information volumes and give prompt reactions, so represent that in the design.

Bank Integration

Having integration with banks is an unquestionable requirement to get monetary data about mobile app users. When a user registers and fills in the vital structures, the data is shipped off to the bank office. Then, at that point, the bank gives the client's credit score, their unwavering quality, which fills in as a reason for additional investment and finance management ideas.

Country and Time Zone

Investing in mobile applications to a great extent relies upon the country the associated banks work in. Truly, monetary regulations and guidelines that oversee branches, alongside working hours, may shift fundamentally. In this manner, you ought to guarantee the information is extricated from the latest updates and does not hurt the client experience.

Code Logging

Most importantly, third-party integration is pivotal to give appropriate code mistake logging, seeing the reasons that have caused blunders, and concluding how you can forestall them later on.

Sandbox Environment

While settling on third-party integration, ensure they all have a sandbox that disengages untested code (and afterward explodes suspect one) in a protected, controlled environment without harming the user data.

Conclusion

Even though the investment in mobile app development demands one-time efforts, it is not an easy process. It demands efforts from a proficient iOS app development company that can keep the user data safe and deliver an exceptional user experience.

FAQs

Q. How Much does the Investment in Mobile App development cost?

The cost estimation of the investment mobile app depends on various factors such as project requirements, location of the development team, skills set requirements, development time and many more.

Q. Why should I hire a dedicated app developer?

Dedicated developers can provide end-to-end support for the process of developing, designing, deploying and supporting any kind of application development for the investment industry. Dedicated mobile developers can bring the best outcomes for your business integrating various tools and technologies.