How AI Is Reshaping Insurance Industry?

Technical Knowledge We Would Like To Share With You

6 Best Tips for Achieving Great Android App Performance

User satisfaction and app performance are two factors that determine the success of any Android app. The post provides essential advice on how to a..

Guide to Developing a Camping Location Finder App for Hill Stations

Are you excited about building an advanced camping location-finding application? Developing such an app requires technical knowledge and expertise...

Importance of Wireframing in Mobile App Development

Wireframing can be considered the bedrock for mobile app development. It paves the way for businesses and developers for more clarity and foresight..

We Were Part of Their Stories.

A glimpse of some of the proud moments of Hyperlink InfoSystem.

What We do To Get The Praise From The Best?

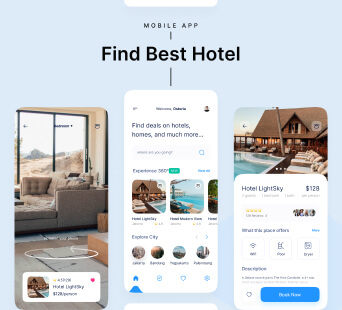

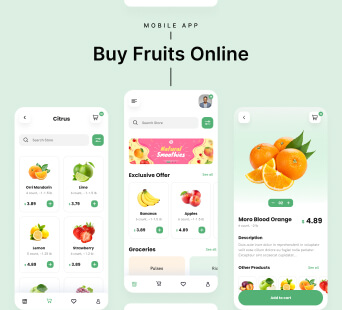

Mobile App

Development

Get the best in class mobile app development services and offer an impressive to immersive user experience to your target audience.

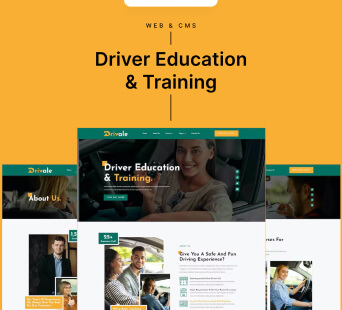

Web & CMS

Development

Make your "just an idea" to be recognized by a worldwide audience, transforming it with phenomenal Web development services.

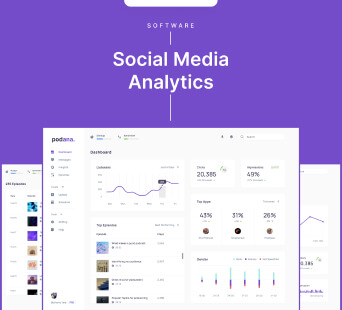

Software

Development

Let our software development experts handle the chaotic programming complexity and deliver elegant and innovative solutions to enhance your business offering. We at Hyperlink InfoSystem offer feature-rich solutions for a wide range of software solutions starting from enterprise-based software to supply chain management or any other custom software development requirements our global clients have got. Hire Software developers from Hyperlink InfoSystem to get the perfect technological solution that can help to minimize human error through automation.

Game

Development

Our game developers hold the experience and expertise to be the best for bots to the boss, offering extensive game development support.

Blockchain

Development

Hire blockchain developers to leverage the extensive security offering of blockchain algorithms and offer top-notch security to your advanced development solutions.

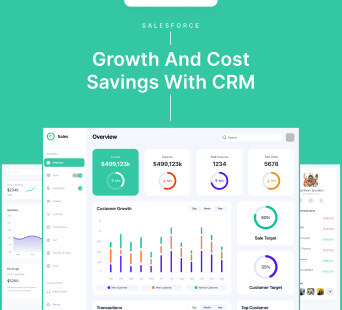

Salesforce

Solutions

Automate, manage and enhance customer relations, sales offerings, marketing strategies, and other affecting areas through our salesforce solutions.

Other

Services

Our developers make sure to justify every one of your requirements just the way you want, no matter how small or big it can be. Whether you need Data science and Big data analytics services to enhance your business operation, want to offer a unique user experience through AI/ML integration, need to build a smart automation system, or it can be a metaverse universe; experts at Hyperlink InfoSystem have got you covered. Got any custom development requirements that we have missed mentioning here? Don't worry, we have got the experts on hand for that as well.

Get Free Quote Now !

Got An Idea? Leave A Message To Us And We Will Reach Out To You Soon.

Developers

Worldwide Clients