Finance & Banking App Development Company

From budgeting to investing, our finance app development services have everything you need to achieve your financial goals.

Ever since the evolution of online banking and mobile banking, FinTech has been on the rise. Finance and banking applications have made our lives easier offering tons of services starting from money transfer activity to investment tracking and more. Being a leading app development company, Hyperlink InfoSystem has been simplifying the user's financial life and providing convenient access to banking and finance app development services.

Our app developers focus on using the latest technologies and development methodologies to ensure that the fintech solutions they develop are not only user-friendly and secure but also future-proofed to adapt to changes in the market and user needs. Being a leading app development company, we specialize in creating innovative and user-friendly finance and banking apps for various platforms, including iOS, Android, and the web.

App developers at Hyperlink InfoSystem have the knowledge and expertise to deliver high-quality apps that meet client needs. Hire app developers from Hyperlink InfoSystem to get innovative solutions for the needs of developing a simple fintech solution to complex solutions of integrating the latest technologies like blockchain, NFT, cryptocurrency, and more. With the help of Hyperlink InfoSystem, you can get nothing but the most innovative and competitive app development solution for your fintech development requirements.

Why Choose Hyperlink InfoSystem For Finance & Banking App Development?

Partner up with the Top Finance and Banking app development company to get the pro-found advantages of industry-specific solutions. Get high-quality FinTech solutions from Hyperlink InfoSystem to build and enhance the business-consumer digital relationship.

97% Success Ratio

We prioritize and fulfill every development requirement with at most care and attention as we know how important it is for you.

Agile Approach

At Hyperlink InfoSystem, we offer the most feature-rich solution with the collaborative effort of self-organizing and cross-functional teams.

Affordable Price

We give equal attention to the price range and quality of the solution to deliver the quality solution at an affordable price range.

Enhanced Development Knowledge

Our developers keep themselves knowledgeable about all the latest development tech trends to deliver the best possible solution.

What We do To Get The Praise From The Best?

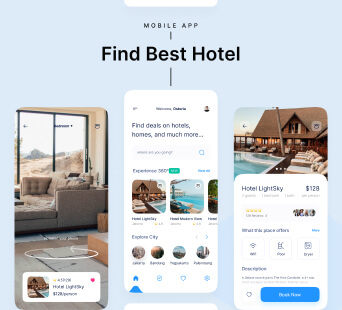

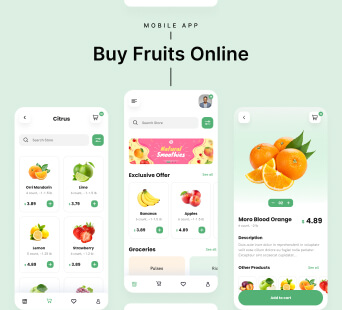

Mobile App

Development

Get the best in class mobile app development services and offer an impressive to immersive user experience to your target audience.

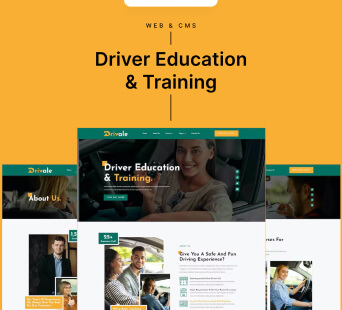

Web & CMS

Development

Make your "just an idea" to be recognized by a worldwide audience, transforming it with phenomenal Web development services.

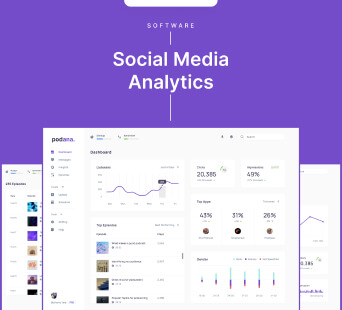

Software

Development

Let our software development experts handle the chaotic programming complexity and deliver elegant and innovative solutions to enhance your business offering. We at Hyperlink InfoSystem offer feature-rich solutions for a wide range of software solutions starting from enterprise-based software to supply chain management or any other custom software development requirements our global clients have got. Hire Software developers from Hyperlink InfoSystem to get the perfect technological solution that can help to minimize human error through automation.

Game

Development

Our game developers hold the experience and expertise to be the best for bots to the boss, offering extensive game development support.

Blockchain

Development

Hire blockchain developers to leverage the extensive security offering of blockchain algorithms and offer top-notch security to your advanced development solutions.

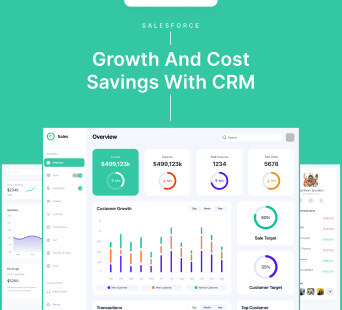

Salesforce

Solutions

Automate, manage and enhance customer relations, sales offerings, marketing strategies, and other affecting areas through our salesforce solutions.

Other

Services

Our developers make sure to justify every one of your requirements just the way you want, no matter how small or big it can be. Whether you need Data science and Big data analytics services to enhance your business operation, want to offer a unique user experience through AI/ML integration, need to build a smart automation system, or it can be a metaverse universe; experts at Hyperlink InfoSystem have got you covered. Got any custom development requirements that we have missed mentioning here? Don't worry, we have got the experts on hand for that as well.

Process We Follow

Being a Top development company, the proficient developers of our teams follow a well-organized development process that includes the following steps.

Requirement Gathering

We help clients to gather and analyze the requirements to understand the functionalities to be integrated into the app. This process enables us to draw a development plan and transform the clients’ concepts into an efficient and functional app.

UI/UX Design

Our developers use effective UI trends to design apps that are not only pleasing to the eye but also intuitiveness and consistency. We make sure the applications not only satisfy the needs of our clients but are also simple and convenient for the end-users.

1800+

UI/UX Designed

Prototype

We develop a preliminary visualization of how the mobile app would look and function. The prototype of the mobile application will give an idea of the look and feel of the app, and we test the users’ reactions to the UI and UX designs.

Development

Our team of app developers has a thorough understanding of different programming languages, frameworks, third-party APIs, and more and will develop logic and codes to make your mobile application browsable for your target audience integrating various features and functionalities.

1800+

App & Web Develop

Quality Assurance

Our developers carefully test every app to ensure that they provide an excellent user experience and meet the requirements of our clients. Apps developed by our development team are bug-free because they go through a series of automated and manual testing before deployment.

1800+

App & Web Tested

Deployment

Our app developers follow strict guidelines and best practices of app stores to make your mobile application good to go. The app deployment phase will make sure your mobile applications can meet all the publishing criteria and reach your target audience.

1800+

App & Web Deploy

Support Maintenance

All digital solutions need improvement. The deployment of an app is not the final stage. We work with our clients to offer post-deployment maintenance and support to make sure the mobile application always stays bug-free and trendy.

24x7

Support

Technical Knowledge We Would Like To Share With You

Native vs. Hybrid App Development Strategies

Financial considerations wield considerable sway within the crucible of app development ventures, serving as linchpins in the decision-making calcu..

How Much Does It Cost to Build an App Like Zalando?

This guide delves into the steps and costs associated with creating e-commerce applications with a similar interface as Zalando. It mainly focuses ..

Top Mobile App Development Tools

Unlock industry-orient strategies to design exceptional mobile apps by learning about the essential tools required for success. Explore this guide ..

Get Free Quote Now !

Got An Idea? Leave A Message To Us And We Will Reach Out To You Soon.

Developers

Worldwide Clients